Wisconsin property taxes are climbing to their highest levels since the Great Recession, and the impact is being felt most acutely in the Northwoods. Driven by rising state and local spending, higher home valuations, and school funding changes that allow increased costs without local voter approval, property tax bills are hitting rural homeowners harder than ever. As enrollment declines, untaxed public land expands, and population growth lags behind rising expenses, northern communities are facing mounting pressure that threatens long-term affordability, economic stability, and the future of the region.

Key Takeaways:

- Property taxes are skyrocketing this year due to increased spending and new home valuations

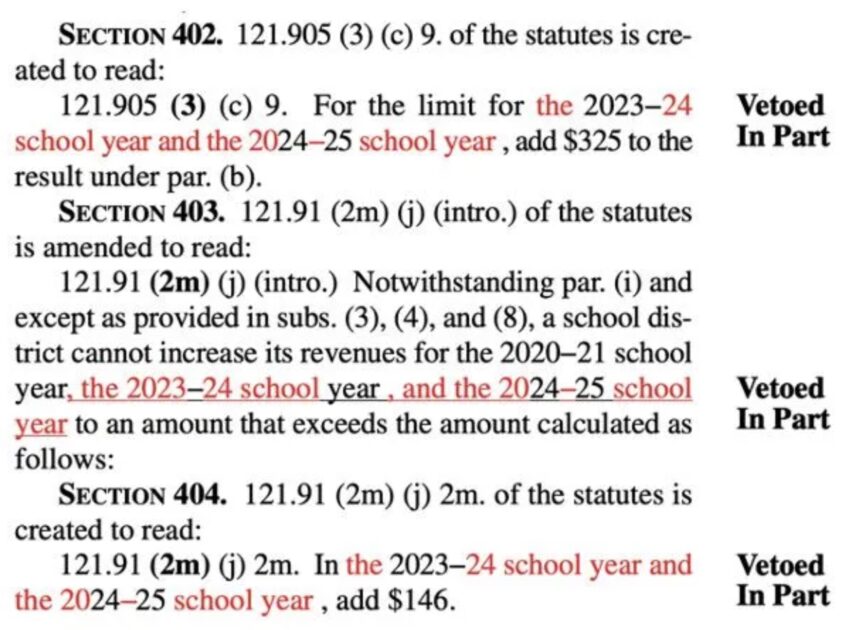

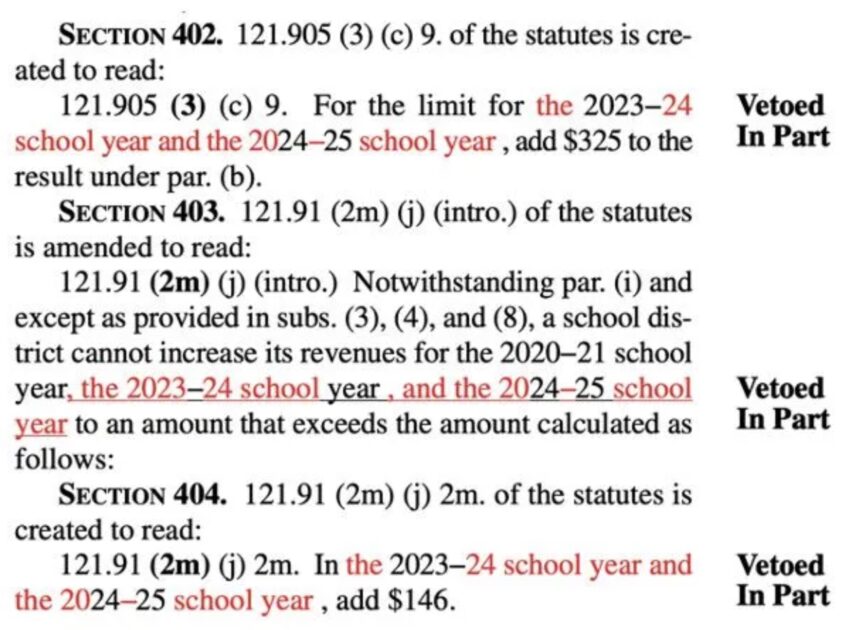

- Despite falling enrollment and increased staffing, Governor Evers’ partial veto allows for increased taxes of $325 per year per student without local approval

- High home valuations due to downstate and out-of-state purchases combined with an aging population, low growth rates, and untaxable land place strain on Northwoods property owners

- State spending is now exceeding revenue, especially squeezing our region and jeopardizing our future

Naughty or Nice, Your Property Taxes Landed Like Coal

Property taxes are hitting mailboxes throughout our region and in many cases, they’re colder than the windchill. This tax is often top of mind but one of the more difficult to understand due to layers of complexity and uncertainty. County, local, school district, and technical college taxes with a host of possible credits.

- You’ll also notice two values on your property: one set by the state and another from local assessments. The state sets a value on your community to ensure equity between municipalities and counties while local values seek an equalized value between property owners.

- If any unit falls behind, others will carry an excess burden for shared services in their district like schools or town expenses. Theoretically the tax should be “fair” and evenly shared.

- This equalized value program ensures that municipalities cannot intentionally undervalue their community and draw in more general aid than they need.

Spending Hikes

The recent state budget included historic aid increases to municipalities and counties with significant K-12 boosts as well. For schools, this increase is the highest bump since 2009.

- All combined, property taxes are set to be the highest they’ve been since the Great Recession and they’re only getting worse.

- State spending is now outpacing collection, cutting into reserves and leading to an extremely difficult budgeting process for 2027.[1]

- Despite additional state aid, counties also increased tax collection by over $250 million. Across the state, we’ve also seen numerous school referendums that have increased tax rates.

If your community did not have a recent referendum, you’re still on the hook for more school spending.

- Using a partial veto, Governor Evers extended revenue limits for 400 years by $325 per pupil, per year.

- Districts can now increase spending up to that limit without local say.

- What was $325 in year one quickly becomes $1,950 by the 2028-2029 school year.[2]

- Year by year, another $325 per student continues to climb at the expense of property owners and, ultimately, the state economy.

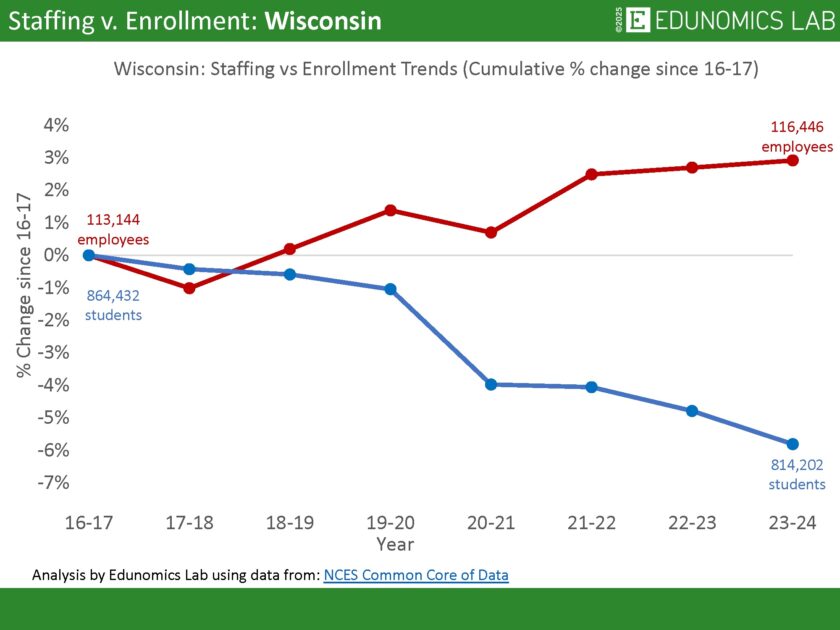

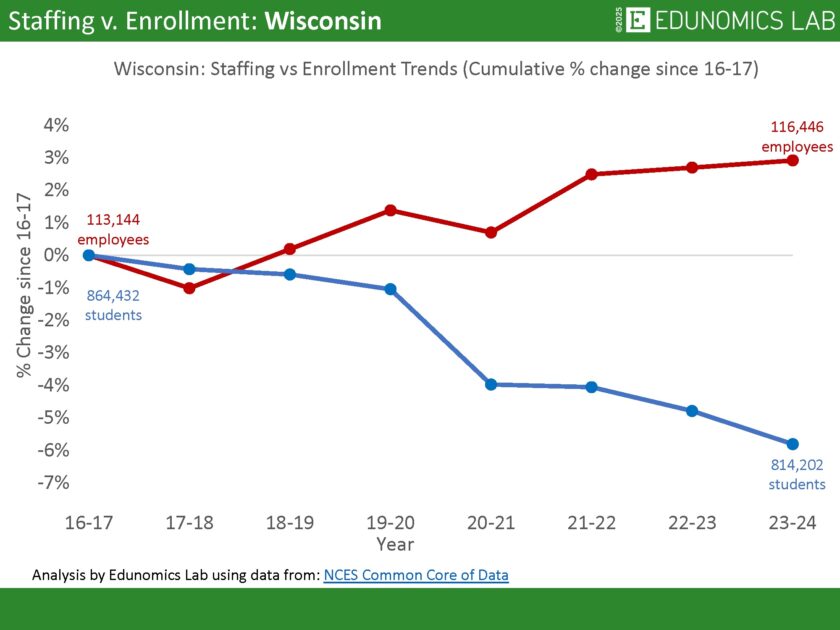

Demographics and student enrollment combined with state and local spending for schools is becoming disconnected from reality. Yes, regardless of how many kids are in a school it must still be heated, the lights must turn on, and the building maintained.

- Since 2016, school employment has risen while enrollment numbers have dropped significantly.

- In rural and northern districts where student enrollment is falling we must work to find cost-saving measures.

- The Northwoods must also pursue new economic opportunities to keep pace with costs and grow communities

Climbing Costs, Climbing Values

Everyone has noticed high costs of doing just about anything. With inflation skyrocketing to 8% in 2022 sandwiched by 2021 and 2023 coming in at over 4%, costs have gone up for every service.

- Inflation can squeeze local communities. Materials and labor for roads are up and labor markets are challenging.

- Utility bills have risen 20% in some areas since 2019, roughly doubling since 2004.

- Home values are quickly on the rise, too. In our region, downstate and out-of-state buyers continue to drive property purchases for their lakefront cabin or wooded retreat. These purchases are impacting local, long-time residents.

- Wisconsin already has a top 10 property tax nationally and is largely uncompetitive across other taxes like our progressive income tax.

- This combination hurts seniors on fixed incomes, working families, younger first-time homebuyers, family farms, and small businesses.

Another issue is taxable property in general. Public lands, non-profits, and many low-income housing units are not taxed.

- In the Northwoods, we are home to the highest concentrations and totals of public land.

- In over half of our counties north of Highway 29, 25% or more of land is public and untaxed.[3]

- We enjoy public access, but it comes at a cost that most in Madison do not consider or adjust for.

The Future

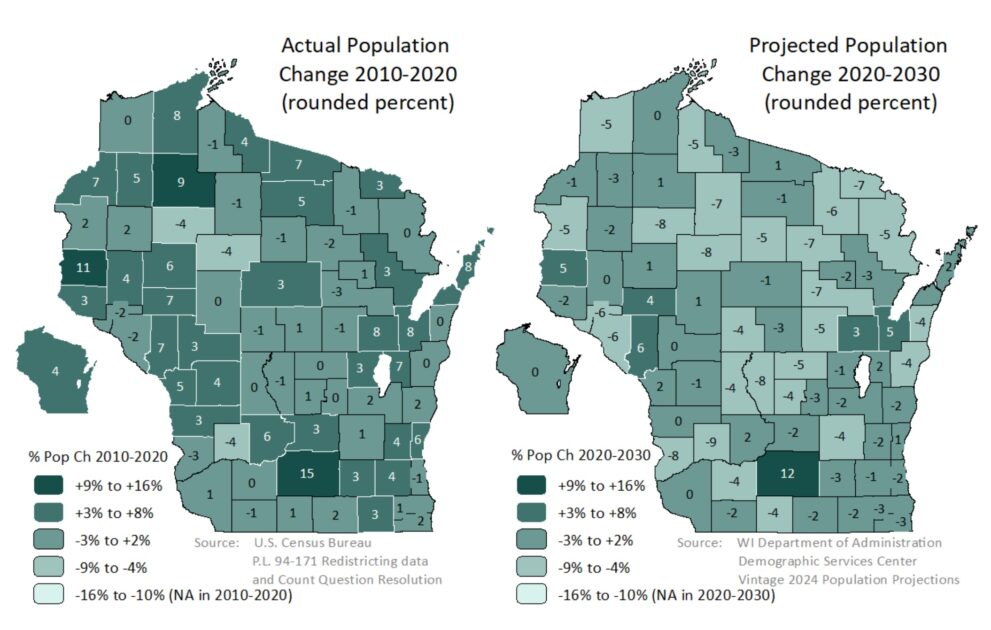

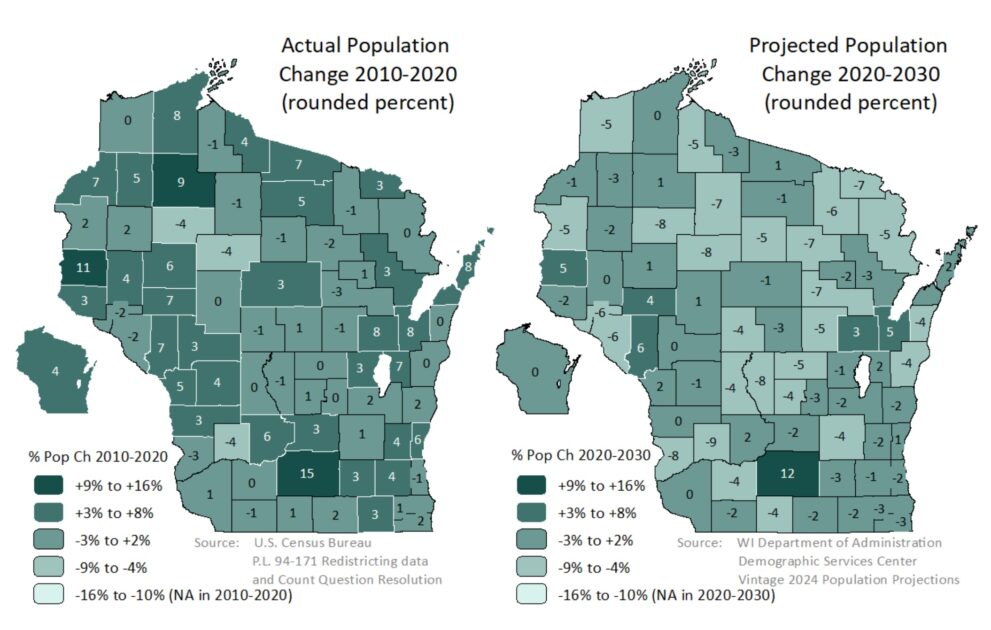

Our communities are not growing enough to keep pace with rising costs and aggressive budgets. As communities shrink, the local property tax base faces upward pressure or significant service cuts. Shrinking or aging communities will face structural squeezes.

- If new home builds are too slow, we can’t share costs or bring in young families.

- Zoning, infrastructure limits, labor pressure, and seasonal constraints make building quickly a challenge.

- Retirements, remote work, and second-home purchases have surged since the pandemic. While we welcome the migration and free-market drivers we must also consider what the second and third order effects are on local economies and communities.

- Tourism dependency is a risky bet that should be hedged with dynamic industries throughout our region.

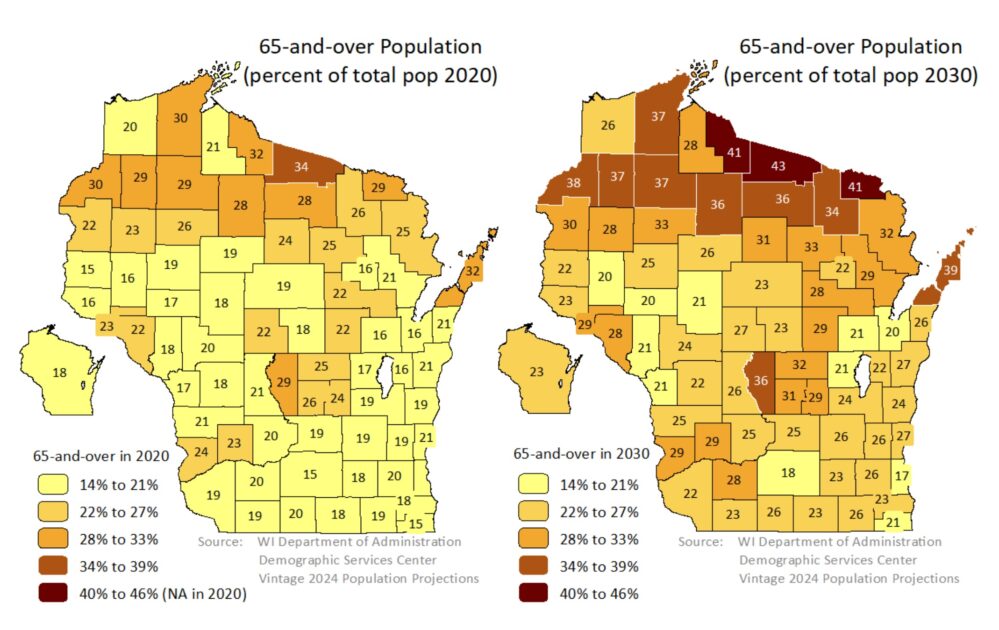

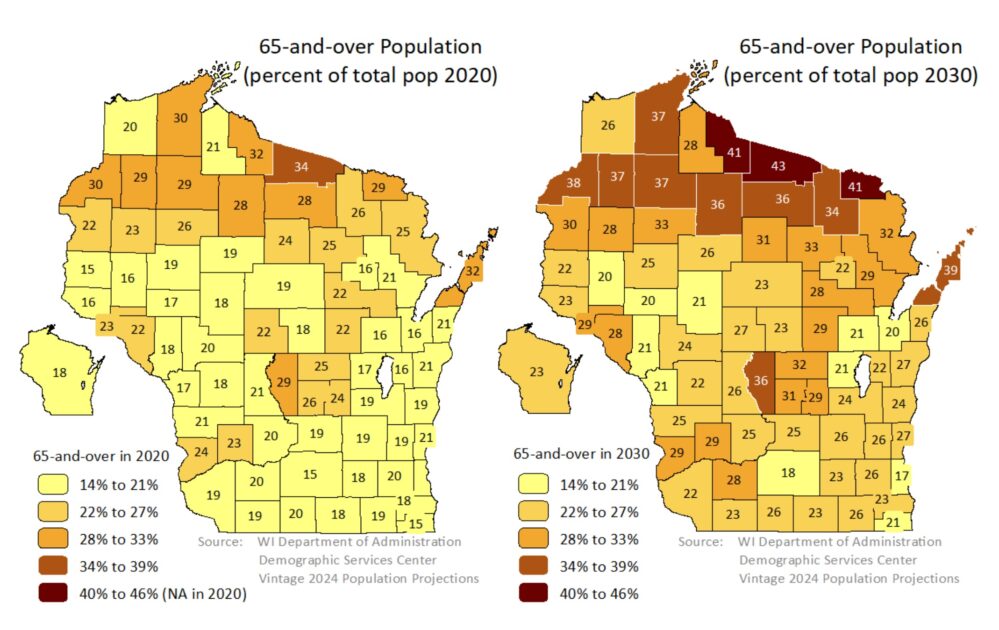

The Northwoods has a higher proportion of 65-and-over residents.[4] Our residents do not deserve to be priced out of the homes they own or the communities they’ve contributed to. Nor should costs of living push potential residents from moving here. The opportunity costs of anti-growth are immeasurable. The chart below highlights the need for growth and the reality of upcoming fiscal constraints.

- Failing to address rising taxes, cost of living, or lack of growth will disproportionately impact the Northwoods and could cost us our future.

- Our region deserves more attention from policymakers and more consideration when it comes to tax policies that are largely driven by the issues of southern communities.

- A dose of Northwoods common-sense would go a long ways.

[1] WPF. An All of the Above Budget. Wisconsin Policy Forum, 2025. https://wispolicyforum.org/research/an-all-of-the-above-budget-state-budget-draws-down-balances-to-cut-taxes-increase-spending/.

[2] Flanders, Will, and Rick Esenberg. ANALYSIS: EVERS 400 YEAR VETO. Wisconsin Institute for Law & Liberty, 2024. https://will-law.org/analysis-evers-400-year-veto/.

[3] Brown, Ari. Wisconsin’s Public Lands. Wisconsin Policy Forum, 2019. https://wispolicyforum.org/wisconsins-public-lands/?utm_source=perplexity.

[4] Department of Administration. State and County Population Projections 2020-2050: A Brief Summary of Findings. Wisconsin State Government DOA, 2020.